Enabling a venture studio to accelerate capital allocations

Why this mattered

Investment decisions depend on synthesizing fragmented, unstructured information into a defensible point of view—under time pressure and with real capital at risk.

Off-the-shelf AI tools could generate summaries, but failed on what mattered most: consistency, traceability, and trust.

The objective was not to produce more analysis, but to reduce decision friction while increasing confidence, explainability, and auditability—so the firm could scale capital deployment without scaling headcount.

Approach

We designed and delivered an AI-first investment workflow grounded in business outcomes, governance, and day-to-day usability:

- Prioritized high-impact decision points with Partners and PICs, aligned to investment workflows

- Co-designed AI-enabled processes with investment teams to ensure early buy-in and rapid feedback

- Decomposed each decision into explicit questions (thesis, risks, assumptions, alternatives)

- Structured and synthesized evidence from approved internal sources

- Ran specialized analysis passes (e.g., risk review, assumption challenge) based on the client’s approved investment frameworks

- Embedded Human-In-The-Loop reviews every week to ensure accountability and auditability

What changed

Teams perceived tangible value in under 60 days, creating internal pull for the transformation.

The solution reached production in under 4 months, compressing a mission-critical due diligence workflow by ~90% while enabling deeper, more nuanced investment analysis than individual expert judgment alone.

The result was not an AI pilot, but a repeatable, governable decision workflow, ready to scale with the firm.

The context & the Client’s case

Organizations across industries have vast amounts of siloed and unstructured data. This includes meeting notes, field notes, reports, spreadsheets, etc. Turning this raw knowledge into actionable and reliable insights remains a slow and costly process.

Our client, an investment firm armed by a Venture Studio, faced that exact challenge. This not only slowed down their investment decisions but also prevented them from scaling without adding more resources.

After trying to do data synthesis using ChatGPT and the likes, it became clear that off-the-shelf AI tools weren’t reliable.

What we were hired to do

The client hired us to advise on a transformation roadmap for the next 12–18 months and implement a concrete AI-first solution to scale their investment decision process.

The key constraints

In such a mission-critical workflow, we faced the following constraints:

- unstructured, unlabelled and fragmented data sources

- explainability of the synthesis made by AI was paramount

- AI decisions must be auditable

- outputs must have same or higher quality VS internal expert judgment

- the AI solution must enable more investment decisions without adding more resources

What we did

We partnered directly with executives and the investment team to:

- Assess readiness (data, governance, decision ownership, risk constraints)

- Design a transformation roadmap to fit with our Client’s operational reality

- Provide a modular architecture to deliver value within 3 months but can scale with the firm’s complexity

- Prioritize a small set of high-value decision workflows worth embedding AI into

- Design an operating model that made outputs auditable and explainable while ensuring the AI solution become embedded in the Client’s investment processes

- Build and deploy a production-grade AI solution on the Client’s cloud environment

Outcomes

Within four months, the client moved from fragmented, intuition-heavy decision making to a repeatable, auditable capital allocation system that could scale with the venture studio.

The engagement delivered outcomes at three levels: decision quality, operating leverage, and governance.

Material acceleration of investment throughput

- End-to-end due diligence cycles were compressed by ~90%, reducing weeks of synthesis and review from weeks to hours.

- Investment teams were able to evaluate more opportunities in parallel without increasing headcount.

- Partners and Investment Committees spent less time reconstructing context and more time debating true decision trade-offs.

Higher consistency and decision quality

- Every investment decision followed the same explicit structure: thesis, assumptions, risks, alternatives, and scoring.

- AI outputs met or exceeded internal expert judgment on defined evaluation criteria, as validated through ongoing EVALS.

- Decisions became more consistent across deals and subjective bias was reduced.

Auditability and trust by design

- Each output was traceable back to approved sources, assumptions, and analytical steps.

- Human-in-the-Loop reviews were embedded as standard operating practice, not exceptions.

- The firm gained a defensible audit trail suitable for internal governance and future regulatory scrutiny.

From pilot to production in less than 4 months

- The solution reached production in under four months and was adopted as part of the core investment workflow.

- Teams perceived tangible value within the first 60 days, creating internal pull.

- The architecture and operating model positioned the client to scale capital deployment and decision complexity without linear cost growth.

In short, the outcome was not “GPT-like analyst”, but a scalable decision infrastructure: one that reduced friction, increased confidence, and enabled the venture studio to allocate capital faster—without compromising quality, rigor, or governance.

Excerpt of some of our work

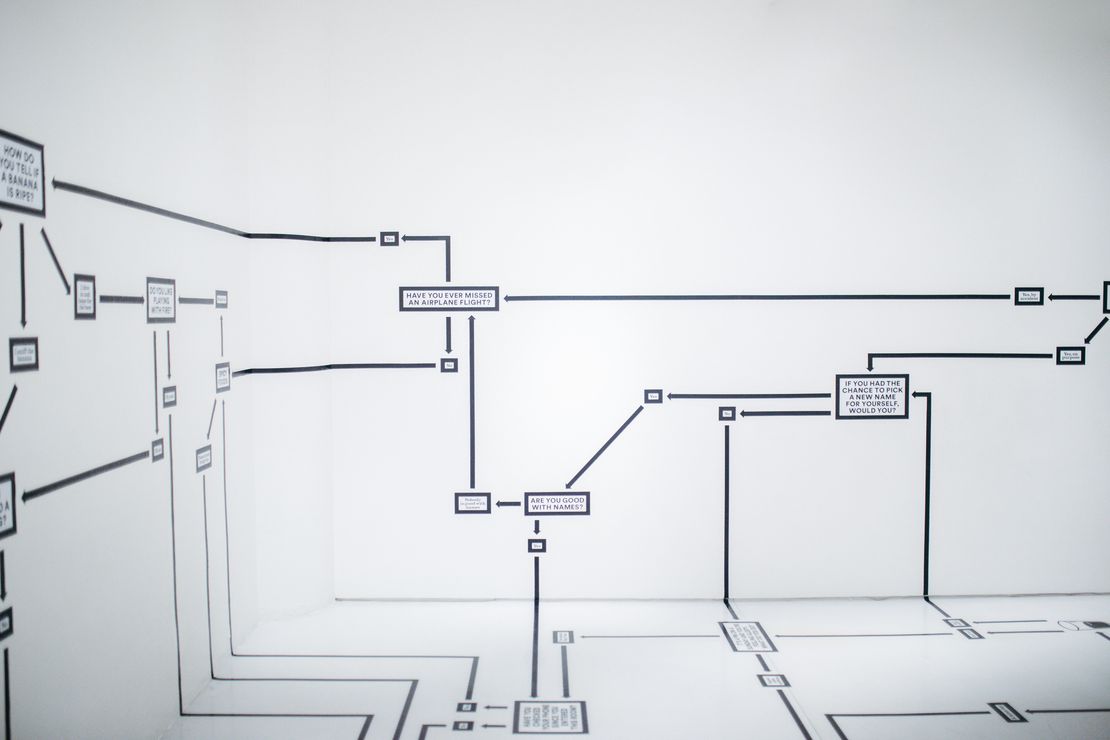

Step 1: mapping the Client’s investment decision framework

Before introducing any technology, we worked with the investment team to make their existing decision process explicit.

This meant clarifying how investment decisions were actually formed today: what inputs were used, how hypotheses were built, where risks were challenged, and who ultimately owned each decision.

This allowed us to clearly map out:

- Decision owners and review points

- Escalation paths

- Architecture choice between autonomous AI and deterministic pipelines

- How we would run EVALS to test and compare AI outputs VS human judgment

- What needed to happen from a change management perspective

flowchart TB

A["Trigger: new opportunity"] --> B["Intake and qualification"]

B --> C{"Fit and priority gate"}

C -- "No / defer" --> C1["Backlog or parked"]

C -- "Yes" --> P1["Phase 1 - Market and problem framing (thesis, ICP, market scan, sizing)"]

P1 --> G1{"Thesis gate"}

G1 -- "Revise" --> P1

G1 -- "Proceed" --> P2["Phase 2 - Commercial diligence (stakeholder calls, validation, GTM stress test)"]

P2 --> G2{"Commercial gate"}

G2 -- "Stop" --> S1["Stop or learnings captured"]

G2 -- "Iterate" --> P2

G2 -- "Proceed" --> P3["Phase 3 - Technical and operational diligence (feasibility, delivery plan, prototype milestones)"]

P3 --> G3{"Feasibility gate"}

G3 -- "Revise scope" --> P3

G3 -- "Proceed" --> P4["Phase 4 - Investment case and structuring (unit economics, value creation plan, IC memo)"]

P4 --> G4{"Approval gate"}

G4 -- "Reject" --> R1["Reject and rationale archived"]

G4 -- "Defer" --> C1

G4 -- "Approve" --> P5["Phase 5 - Post-investment execution (activation, KPI follow-up, pivot/scale/exit)"]

P5 --> Z["Outcomes narrative and lessons learned"]

Z -.-> B

X["Cross-cutting controls Evidence log • Assumptions register • Decision log • Risk register • Comms tracker"]

P1 -.-> X

P2 -.-> X

P3 -.-> X

P4 -.-> X

P5 -.-> X

Step 2: defining the relevant transformation roadmap

With a clear view of the decision framework, we identified where AI could create material leverage, and where it should not be applied.

The roadmap focused on a small number of high-impact decision moments, sequencing change to deliver value quickly while preserving trust and governance.

We also defined the people and operational changes required to make the most of this AI transformation. Indeed, the goal was not to replace 100% of human tasks, but rather to augment teams with the right AI agents.

Deliverables our Client got as a result:

- Transformation roadmap with AI modules prioritized based on business needs

- Modular architecture to give them optionality as to when and what to scale

- Onboarding and training plans for their teams for each key AI modules

- Identified step changes enabling new capabilities and their timing

Step 3: designing a scalable technical architecture

Once decision ownership and operating constraints were clear, we started to design the technical system to support them.

The architecture was built to fit existing tools and processes, while enabling reviewable outputs, traceability, and long-term scalability.

With short time-to-value in mind (less than 3 months) and AI explainability as first-class citizen, we used the following design patterns:

- Team of atomic AI Agents with strict schema validation and explanation lineage

- EVALS using LLM-as-a-judge and rubrics co-developed with our Client

- Loose coupling of the different AI modules to let Client scale certain capabilities based on operational needs

- Embedded human-in-the-loop reviews and audit trails by default

Deep dives

Part of Enabling a venture studio to accelerate capital allocations

Decision mapping process

Challenge: Complex investment decisions needed clear frameworks and systematic approaches.

Solution: Structured decision mapping methodology to optimize investment workflows.

Read case study

Part of Enabling a venture studio to accelerate capital allocations

Multi-agent AI workflows (technical deep dive)

Challenge: Venture due diligence constrained by analyst throughput, preventing faster capital deployment.

Solution: Multi-AI-agent solution autonomously performing investment-grade analysis with Human-In-The-Loop.

Read case study